April 2022, concludes my first year in swing trading and wow, I have learnt a lot. I didnt even realise it’s been a full year. In some aspects it feels like a lot longer and in other aspects, it feels a lot faster.

I therefore wanted to complete a summary to try and provide a good recap of what my results have been.

- My mindset has changed, I no longer believe that set and forget is the best solution for trading. I am mentally just not interested in long term investing (I do still do this but it is a smaller proportion of my portfolio but I will always set sell limits, so if a stock was to climb fast I’ll likely sell and take the gains).

- I’ve read a few books, which have been great help towards the skill set I’ve started to develop. My favourite and the one I think I’ve learnt the most from, has to be “how to swing trade” by Brian Pezim. He teaches it like your a normal person and not a financial guru.

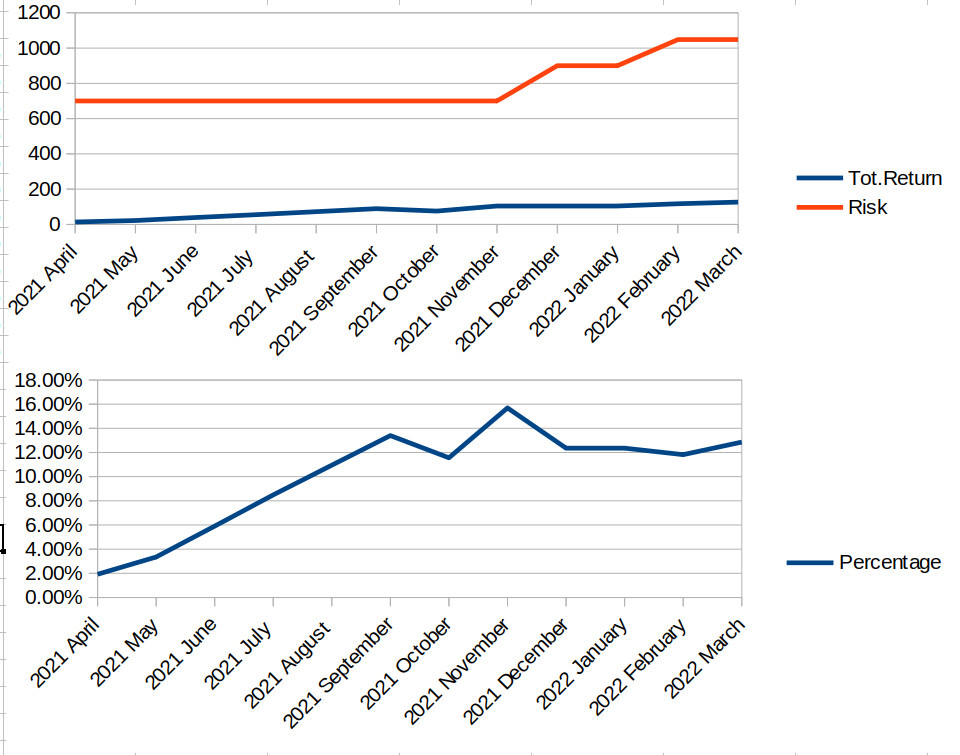

- Looking at the results, my realised results are good because they came in at 12.86% for the first year. This includes the increase in my initial swing trading budget, and any dividends I received during my swings.

- My overall performance wasnt so good though, when I factor in what I’m still holding, my actual returns are -4.71%, so I obviously still have a lot to learn.

- My main take away from this, is that I need to probably be setting stop losses, rather than holding and trying to average down. $NAT, $CINE and $ALO are the big losses I’m holding. I have seen NAT come back significantly in the last month or so, but $CINE might be a big write off. I do believe that I will see $ALO come back, but unfortunately all of these will take time, and are now long term holds (I’ve lost so much it’s not worth cutting them off).

- The last thing I noted, is that the market has been rough in the last 6 months of my swing trading. This can be seen in the S&P 500, which shows a drop from almost 4800 down to just under 4200 in the last 6 months (so the market has taken a down turn). My gains where nearly all made in the first 6 months of my trading and from then on, it was about holding them (which we could argue, I didn’t because I am currently holding a few open positions).

Below is an image of the swing trading progress I performed. You can see the increase in finance over the last part of the year. Which obvious impacts the percentage gain, but never the less I did hit 16% high realised gains, before being pulled back down.

All in all though, I made on average 1% per calendar month and this beats the banks (if excluding open positions). I’m quite impressed with myself. The realised gain, was significant to try and do this again for another year. Maybe try and learn from my mistakes.